We are fortunate to have our charming Town of Shaunavon amidst the tremendous beauty of Southwest Saskatchewan! Let’s continue to do our part as a community to keep our town beautiful for the many generations to come! Join us for our COMMUNITY CLEANUP DAY on Tuesday May 6th. Meet at the Randy Surjik Memorial Amphitheater at 6:30 pm.

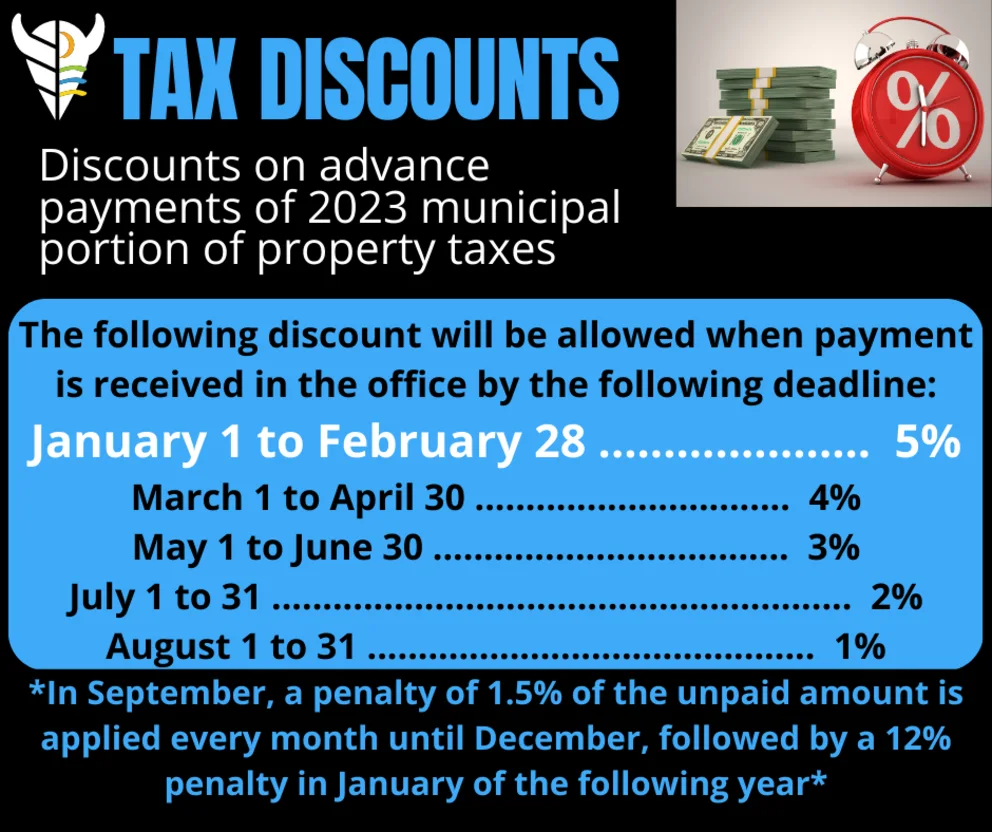

Did you know that we begin accepting payments for property taxes in January for the current year?

The 2023 tax notices will not be mailed until the assessment for the year has been established and the mill rate set. Discounts are based off of 2022’s tax levy as 2023 taxes will not be levied until at least April. The Town encourages taxpayers to set up monthly payments, either with their bank or by dropping off postdated cheques to the Town Office.

The following discount will be allowed when payment is received in the office by the following deadline:

January 1 to February 28: 5%

March 1 to April 30: 4%

May 1 to June 30: 3%

July 1 to 31: 2%

August 1 to 31: 1%

The maximum discount of 5% on prepaid taxes ends February 28th, 2023.

In September, a penalty of 1.5% of the unpaid amount is applied until December, followed by a 12% penalty in January of the following year.

NOTE: We emphasize that any outstanding 2022 Property Taxes & Utilities are subject to a 12% penalty and are still required to be paid.

To view the full Tax Incentives and Penalties bylaw, please visit https://www.shaunavon.com/page/assessment-taxation/

For those interested in receiving their utility and tax notices electronically, to help reduce costs and environmental impacts, you can download the Town of Shaunavon “E-bill Authorization Form” at https://www.shaunavon.com/page/bylaws-policies-forms/